Analyzing the market to your advantage

It has been said by many experienced traders that Forex is a more volatile market than any of the available options. The theory goes that it is difficult enough to judge a single company’s value at a given time and in the future, just imagine how hard it is to do the same thing with a whole country. This philosophy takes the point of view that analyzing the Forex market relies on careful reading over a period of time. Some knowledge of world affairs is also advantageous, as it allows you to be aware in advance of the timing of important announcements which can cause market volatility.

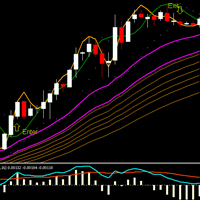

Others will treat the Forex market exactly like they would treat any other stock market, and take a more technical approach to analyzing their next step. This is not as simple a process in Forex as it is in the stock market, as the Forex is a 24-hour market, and the data-gathering systems require some modification to work effectively on Forex. Nonetheless, where these methods of technical analysis have been correctly applied, they have proved to be an effective way of making a profit on the Forex market just as their original forms proved on other markets.

While the first method is more of a global, evidence-based approach and the second tends towards techniques and patterns, both have been proven to be successful if correctly applied. It is highly advisable, though, to recognise which one to apply at a given time, as confusion can easily arise around what exactly the data tells you. Pick the method that you require and use the other to supplement it. That is the only way you can confidently operate in the long term.